Today Superscript, the digital insurance broker, releases the findings from its research into the challenges of running a business – highlighting SME owners’ concerns around maintaining cash flow and balancing work and home life.

The challenges of being a business owner

22% said their most challenging task was managing cash flow, and 41% don’t have emergency funds and would struggle if they went without work for six months.

30% said managing tax admin was the most time-consuming, and business owners put in the hours. Despite being in control of their holidays, a third only take a fortnight or less off a year.

One in five find maintaining good mental health a struggle, despite resources being available – as 10% said they receive helpful resources for their business from mental health websites.

Regardless of the challenges, 73% said becoming a business owner is the best decision they’ve made.

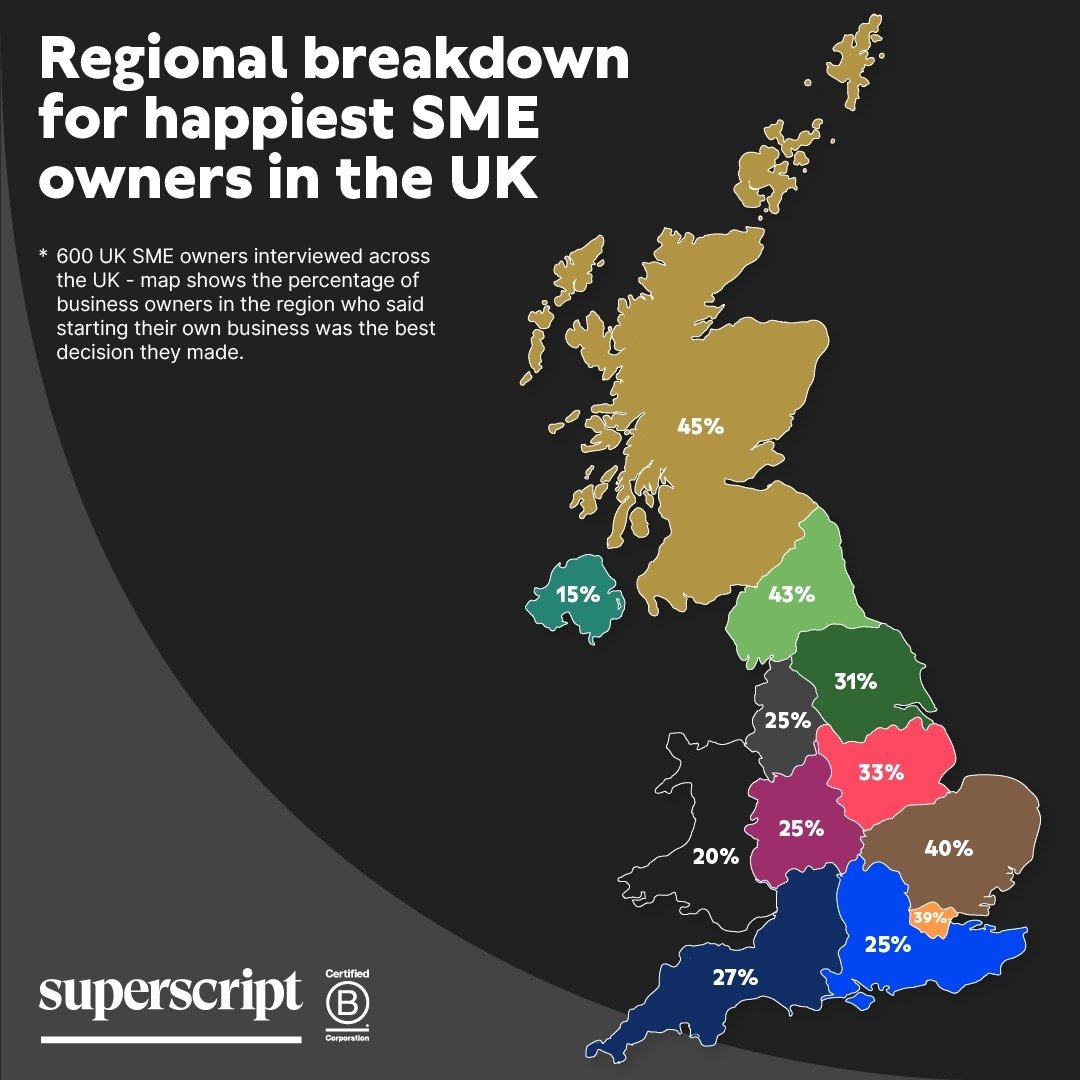

Where are the happiest SME owners in the UK?

We broke down the results to see which region produces the happiest SME owners:

Lucy Robinson, owner of Lucy Locksmith in Wivelsfield Green in East Sussex, commented on the rewarding aspect of being your own boss and the importance of having a strong support network:

“The best thing about being your own boss is picking your own hours and working around my kids.

It can be tricky getting called out to jobs after hours – but I have an amazing husband who helps when I have to go out on call. And I don’t have to get anyone to approve my holiday requests.“

While being a business owner is challenging, with the right resources and planning it can be incredibly rewarding. Steve Mulgrew, owner of Home & Garden Electrics, said:

“One of the things that I’ve really noticed since going self-employed is having more time with the family, and as a bonus, I can take holidays whenever I like rather than being tied to set times.

The main drawback of running your own business is that if you are not working, no one is. I think it’s important to have a reset day once in a while so I look ahead in the diary and if there is a run of fairly big jobs I block out a day afterwards to recover.”

Superscript’s commitment to SME owners

Stephen Taylor, Head of SME Distribution at Superscript;

“As an award-winning digital broker, we know businesses and landlords need the right cover, delivered in a way that works for them.

The SME market plays a vital role in the UK economy and we’re committed to providing them the services they need to thrive.

We listen to our customers’ challenges and that’s why we’ve built a team of friendly experts who help businesses and landlords navigate our broad range of insurance products providing guidance and support.

We’re creating a seamless experience whether that’s online or over the phone — so businesses don’t need to spend unnecessary time or money and can get back to doing what they do best.”

Cameron Shearer, CEO at Superscript;

“Small and medium enterprises are the driving force behind the UK economy – at Superscript we champion their spirit and strive to enable their growth with solutions that make a real difference.

Our mission is to make buying insurance simple, accessible, and tailored to their unique needs. This research is a reflection of our commitment to understanding and addressing their needs beyond transactions.

We aim to be more than an insurance provider; we strive to be a partner and a catalyst for their growth. As a certified B Corporation, Superscript is dedicated to building an ecosystem where businesses, from sole proprietors to ambitious scale-ups, can thrive at every stage of their journey.”

Superscript is a digital insurance broker built for any type of business, with a journey to match. Superscript offers advisory and broking services alongside a fully self-serve online platform where customers can buy and manage their insurance in a matter of minutes. Powered by our technology. Made possible by our people.

It is the first UK-based insurtech to become a Lloyd’s of London broker and is dual-regulated across Europe with a growing global footprint. Proprietary machine-learning technology and a unique multi-carrier model streamlines service and delivery, regardless of risk complexity, geography or industry.

Superscript has raised £65m to date, completing its Series A funding round in 2020 and Series B in 2022. Investors include BHL UK, The Hartford, Seedcamp and Concentric.

A proud Certified B Corp, Superscript is working towards building a better world benefitting people, communities and the planet. In 2024 Superscript was named Schemes Broker of the Year at The Insurance Times Awards.

600 SME owners were surveyed across the UK

Infographic breakdown of regional happy SME owners:

45% of SME owners in Scotland said it was the best decision.

43% of SME owners in the North East said it was the best decision.

40% of SME owners in the East of England said it was the best decision.

39% of SME owners in London said it was the best decision they made.

33% of SME owners in the East Midlands said it was the best decision.

31% of SME owners in Yorkshire & Humber said it was the best decision.

27% of SME owners in the South West said it was the best decision.

25% of SME owners in the West Midlands said it was the best decision.